Best Insurance Providers in New York

- Travelers: Best car insurance company overall.

- Auto-Owners: Best for affordability.

- State Farm: Best mobile app ratings.

- American Family: Best for customer satisfaction.

- USAA: Best for military members.

Travelers: Best Car Insurance Company Overall

Travelers is one of the most well-established and trusted insurance providers in the United States. With a long-standing history of reliability and customer satisfaction, Travelers has built a solid reputation for offering comprehensive car insurance coverage, competitive rates, and excellent customer service. Whether you’re a new driver, a seasoned motorist, or a business owner looking to insure a fleet of vehicles, Travelers provides a wide range of insurance solutions to meet various needs.

Why Travelers Stands Out

When it comes to car insurance in New York, Travelers is particularly popular due to its extensive range of policies and flexible options. The company is known for catering to both individuals and businesses, ensuring that all customers can find coverage that suits their specific requirements. With a strong financial foundation and a commitment to handling claims efficiently, Travelers has earned its reputation as one of the best car insurance providers in the industry.

Key Features of Travelers Insurance

1. Comprehensive Coverage Options

One of the major advantages of choosing Travelers is the extensive coverage options available. The company offers policies that include:

- Liability Coverage: Protects you against financial loss if you are responsible for an accident that causes injury or property damage.

- Collision Coverage: Covers the cost of repairs or replacement if your vehicle is damaged in an accident.

- Comprehensive Coverage: Provides protection against non-collision incidents such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Ensures you are covered if you are involved in an accident with a driver who has little or no insurance.

- Medical Payments Coverage: Helps pay for medical expenses resulting from an accident, regardless of who is at fault.

- Personal Injury Protection (PIP): Offers additional medical and lost wage coverage in the event of an accident.

2. Multiple Discount Opportunities

Travelers offers a variety of discounts to help customers lower their insurance premiums. These include:

- Safe Driver Discount: Rewards drivers who maintain a clean driving record without accidents or violations.

- Multi-Policy Discount: Encourages customers to bundle their auto insurance with home or renters insurance for additional savings.

- Multi-Car Discount: Provides a discount for insuring more than one vehicle under the same policy.

- Good Student Discount: Offers savings for young drivers who maintain good grades in school.

- Driver Training Discount: Available for those who complete an approved defensive driving course.

- New Car Discount: Offers reduced rates for insuring a new vehicle.

3. Financial Stability and Claims Handling

Travelers has a strong financial standing, which ensures that claims are handled efficiently and fairly. The company has high ratings from major financial rating agencies, demonstrating its ability to pay out claims promptly. This reliability is crucial for policyholders who want peace of mind knowing that their insurer will be there when needed.

4. Exceptional Customer Support

Customer service is a priority for Travelers. The company provides 24/7 support, allowing policyholders to file claims, ask questions, and receive assistance at any time. Travelers also offers a user-friendly website and mobile app, making it easy to manage policies, view documents, and make payments online.

Travelers stands out as one of the best car insurance providers in the industry due to its wide range of coverage options, multiple discounts, financial stability, and excellent customer service. Whether you are looking for basic liability coverage or comprehensive protection, Travelers has a policy to suit your needs. If you want a reliable insurer that offers flexibility, affordability, and outstanding support, Travelers is an excellent choice for car insurance in New York and beyond.

If affordability is your top priority when selecting a car insurance provider, Auto-Owners is an excellent choice. While it may not be as widely recognized as some of its larger competitors, this insurance provider consistently delivers lower-than-average premiums while maintaining a high standard of coverage and customer service. With a reputation for reliability and cost-effectiveness, Auto-Owners is a strong contender for budget-conscious drivers who do not want to compromise on quality.

Why Choose Auto-Owners?

Auto-Owners stands out in the car insurance market because it manages to balance cost-efficiency with comprehensive coverage. Many insurance companies offer cheap policies, but they often come with limited benefits or poor claims service. Auto-Owners, however, provides excellent value by ensuring policyholders get affordable premiums alongside high-quality service and flexible coverage options.

Key Features of Auto-Owners Insurance

1. Competitive Pricing with Various Discount Opportunities

One of the biggest advantages of choosing Auto-Owners is its commitment to affordability. The company offers highly competitive pricing that is often below the national average. Additionally, policyholders can take advantage of numerous discounts to further reduce their premiums, such as:

- Multi-Policy Discount: Bundling auto insurance with homeowners, renters, or life insurance policies can lead to significant savings.

- Multi-Car Discount: Insuring multiple vehicles under the same policy results in lower rates.

- Safe Driver Discount: Rewards policyholders who have a clean driving record with no recent accidents or traffic violations.

- Good Student Discount: Offers reduced rates for young drivers who maintain a strong academic record.

- Paid-in-Full Discount: Encourages customers to pay their entire premium upfront by offering a discount for doing so.

- Green Discount: Policyholders who opt for paperless billing and online statements can receive additional savings.

2. High Customer Satisfaction Ratings for Claims Processing

Despite offering lower premiums, Auto-Owners does not compromise on customer service. The company has consistently received high ratings for claims satisfaction, demonstrating its efficiency in handling claims quickly and fairly. Many customers appreciate the seamless claims process, which ensures they get the support they need without unnecessary delays.

Auto-Owners also offers a unique “No-Claims” benefit, where policyholders who remain claim-free for a specified period may receive lower rates or additional perks. This encourages safe driving while rewarding responsible policyholders.

3. Personalized Service Through a Network of Local Agents

Unlike many large insurance providers that rely on call centers and automated systems, Auto-Owners maintains a strong presence through its network of independent local agents. This personalized approach ensures that policyholders receive individualized attention, tailored recommendations, and assistance from professionals who understand their unique needs. Whether you need help selecting coverage or filing a claim, having a dedicated local agent can make the process smoother and more convenient.

4. Comprehensive Policy Options with Add-Ons for Enhanced Coverage

Auto-Owners provides a variety of policy options to cater to different drivers and coverage needs. In addition to standard liability, collision, and comprehensive coverage, policyholders can choose from several valuable add-ons, including:

- Roadside Assistance: Offers emergency support for towing, flat tires, battery jump-starts, and lockouts.

- Rental Car Reimbursement: Covers the cost of a rental vehicle while your car is being repaired due to a covered claim.

- Gap Insurance: Helps cover the difference between your car’s actual cash value and the amount you owe on your auto loan if your car is totaled.

- Accident Forgiveness: Protects drivers from premium increases after their first at-fault accident.

- Diminished Value Coverage: Compensates for the loss of a vehicle’s resale value after repairs from an accident.

Auto-Owners is a top-tier choice for those seeking affordable car insurance without sacrificing service quality or coverage options. With its competitive pricing, extensive discount opportunities, strong customer satisfaction ratings, and personalized approach through local agents, Auto-Owners offers an outstanding balance of cost-effectiveness and reliability. If you’re looking for a budget-friendly insurer that still provides excellent coverage and support, Auto-Owners is a great option to consider.

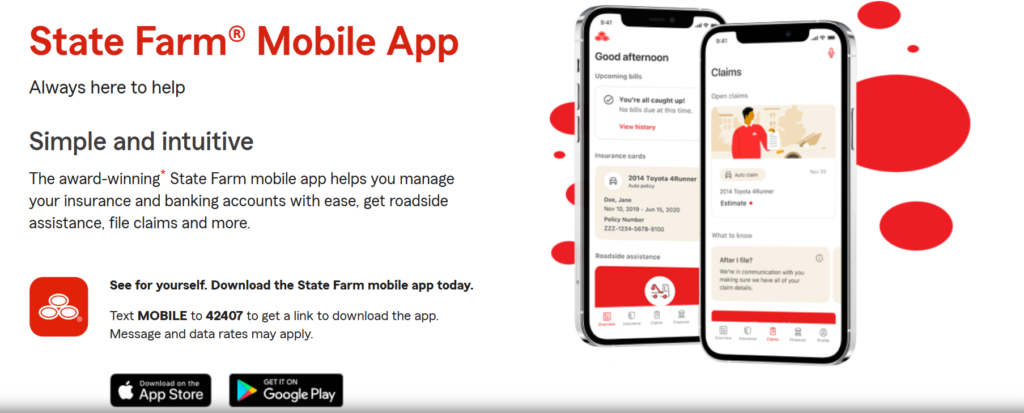

For those who prefer managing their car insurance digitally, State Farm stands out as one of the best options available. The company has developed a highly rated mobile app that provides a seamless and user-friendly experience for policyholders. Whether you need to file a claim, access your ID cards, check your coverage details, or get real-time assistance, State Farm’s mobile app makes it all possible with just a few taps on your smartphone.

With a strong presence in New York and a commitment to providing excellent customer service, State Farm has become a preferred choice for many drivers. Beyond its digital advantages, the company offers a vast agent network, attractive discounts, and a reputation for handling claims efficiently, making it a top contender in the insurance market.

Key Features of State Farm

1. Highly Rated Mobile App for Easy Policy Management

One of the standout features of State Farm is its mobile app, which is consistently rated as one of the best in the industry. The app offers a variety of convenient functions, including:

- Filing Claims: Policyholders can quickly report an accident or damage through the app and track their claim status in real time.

- Accessing ID Cards: No need to carry a physical insurance card—users can display a digital version directly from their smartphone.

- Managing Policies: Customers can update their coverage, review policy details, and make payments effortlessly.

- Roadside Assistance: The app provides easy access to roadside help in case of emergencies like flat tires, dead batteries, or lockouts.

- Drive Safe & Save Integration: Users can monitor their driving habits and earn discounts based on safe driving behaviors.

2. Extensive Agent Network Across New York

While many customers appreciate digital convenience, others still value personal interactions with insurance agents. State Farm maintains an extensive network of agents throughout New York, ensuring that customers who prefer face-to-face consultations can receive personalized guidance and support. Whether you need help choosing the right policy, understanding coverage options, or navigating a claim, State Farm’s agents provide expert assistance tailored to your needs.

3. Excellent Discounts for Policyholders

State Farm offers a variety of discounts to help customers lower their insurance premiums. Some of the most notable include:

- Drive Safe & Save: A telematics-based program that tracks driving behavior and rewards safe drivers with discounts.

- Good Student Discount: Available to students who maintain high grades, helping young drivers reduce their premiums.

- Multiple Vehicle Discount: Offers savings when insuring more than one car under the same policy.

- Bundling Discount: Customers who combine auto insurance with homeowners or renters insurance can benefit from lower rates.

- Accident-Free Discount: Rewards long-term policyholders who maintain a clean driving record without accidents.

4. Strong Customer Service and Efficient Claims Processing

State Farm has built a strong reputation for providing excellent customer service. The company offers 24/7 claims support, ensuring that policyholders receive assistance whenever they need it. Claims processing is known to be smooth and efficient, with many customers reporting quick resolutions and fair settlements.

Additionally, policyholders have access to multiple communication channels, including phone, online chat, and in-person consultations through the agent network. This flexibility ensures that customers can get the help they need in a way that suits their preferences.

State Farm excels in digital convenience while maintaining the benefits of traditional customer service. With one of the highest-rated mobile apps in the insurance industry, an extensive network of agents across New York, valuable discounts, and a strong reputation for customer satisfaction, State Farm is an excellent choice for drivers who want both technological ease and reliable support. Whether you prefer managing your policy on your phone or working with a dedicated agent, State Farm offers a well-rounded insurance experience tailored to your needs.

When choosing a car insurance provider, customer satisfaction is one of the most important factors to consider. A company that offers competitive rates and extensive coverage options is valuable, but a provider that consistently delivers excellent customer service can make all the difference. American Family Insurance is widely recognized for its high levels of customer satisfaction, making it a top choice for policyholders who prioritize personalized service and reliable support.

Why American Family Stands Out

American Family Insurance has earned a strong reputation for putting its customers first. The company has received high ratings in customer satisfaction surveys and policyholder reviews, thanks to its commitment to service, personalized approach, and comprehensive coverage options. Whether you’re looking for auto insurance, home insurance, or life insurance, American Family provides flexible and customizable plans to meet your needs.

Key Features of American Family Insurance

1. High Customer Satisfaction Ratings

One of the biggest strengths of American Family is its consistently high customer satisfaction scores. The company has received positive reviews from policyholders due to its responsive claims handling, friendly customer service, and commitment to addressing individual needs. American Family is frequently ranked among the top insurance companies in customer service satisfaction surveys, reinforcing its reputation as a customer-centric provider.

2. Wide Range of Insurance Products

American Family goes beyond just offering car insurance. The company provides a variety of insurance products to protect different aspects of your life, including:

- Auto Insurance: Covers everything from liability and collision to comprehensive and uninsured motorist protection.

- Home Insurance: Protects homeowners from property damage, theft, and liability risks.

- Renters Insurance: Offers coverage for personal belongings and liability protection for renters.

- Life Insurance: Provides financial security for your loved ones in case of an unexpected event.

- Business Insurance: Helps small businesses manage risk and protect their assets.

With such a broad selection of insurance options, American Family allows customers to bundle multiple policies, leading to additional savings and convenience.

3. Unique Coverage Options

American Family sets itself apart with several unique coverage options that provide extra protection for policyholders. Some of these include:

- Accidental Death Coverage: Provides financial protection for your family in case of a fatal accident.

- Emergency Roadside Assistance: Helps with towing, battery jump-starts, fuel delivery, and other emergency services.

- Gap Insurance: Covers the difference between what you owe on your car loan and the actual cash value of your vehicle if it’s totaled.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages regardless of fault in an accident.

These additional coverage options give policyholders peace of mind and extra financial security in case of unexpected events.

4. Flexible Payment Plans and Discounts

American Family understands that affordability is important for policyholders. The company offers flexible payment plans that allow customers to choose payment schedules that fit their budgets. Additionally, there are numerous discounts available, including:

- Multi-Policy Discount: Savings for bundling auto, home, and other insurance policies.

- Safe Driver Discount: Rewards policyholders with a clean driving record.

- Loyalty Discount: Offers savings for long-term customers.

- Teen Safe Driver Discount: Provides a discount for young drivers who complete a safe driving program.

These discounts and flexible payment options make American Family an affordable choice for individuals and families looking for quality insurance coverage.

American Family Insurance is an excellent option for customers who value strong customer service, comprehensive coverage options, and affordability. With high customer satisfaction ratings, a diverse selection of insurance products, unique coverage options, and flexible payment plans, American Family stands out as one of the best choices for those looking for a reliable and customer-focused insurance provider. Whether you need auto, home, life, or business insurance, American Family is committed to providing the protection and support you need.

USAA (United Services Automobile Association) is widely recognized as the best car insurance provider for military members and their families. Founded in 1922 by a group of Army officers, USAA has maintained a strong commitment to serving those who serve the nation. It offers exclusive benefits, highly competitive rates, and outstanding customer service, making it an excellent choice for eligible individuals. While membership is restricted to active-duty military personnel, veterans, and their families, those who qualify will find that USAA provides some of the best coverage and service available in the insurance industry.

Why USAA is the Top Choice for Military Members

USAA stands out among insurance providers because it understands the unique needs of military personnel. From deployment discounts to flexible payment options, USAA ensures that military families receive tailored coverage that accommodates their lifestyle. Additionally, the company is known for its exceptional customer satisfaction, consistently ranking at the top in industry surveys.

Key Features of USAA Insurance

1. Exclusive Benefits for Military Personnel

One of USAA’s biggest advantages is the exclusive benefits it provides to military members and their families. Some of these benefits include:

- Deployment Discounts: If a policyholder is deployed and stores their vehicle in a secure location, they may qualify for a significant discount on their premium.

- Overseas Coverage: For those stationed abroad, USAA provides international auto insurance options.

- Flexible Payment Plans: Understanding that military pay schedules may differ from civilian ones, USAA allows flexible payment options to accommodate service members.

- Storage Discounts: Members who are deployed and need to store their vehicle can receive reduced rates while their car is not in use.

2. Consistently High Customer Satisfaction Ratings

USAA is known for its exceptional customer service, consistently receiving high ratings from policyholders. Many customers praise the company for its ease of claims processing, helpful customer support, and transparent policies. USAA frequently ranks at the top in J.D. Power customer satisfaction surveys, outperforming other major insurers in terms of service quality and reliability.

3. Competitive Pricing and Discounts

USAA provides some of the most competitive car insurance rates in the industry. In addition to affordable base rates, the company offers a variety of discounts to help policyholders save even more, including:

- Safe Driver Discount: Rewards drivers with a clean driving record.

- Multi-Vehicle Discount: Provides savings for insuring more than one vehicle under the same policy.

- Loyalty Discount: Offers price reductions for long-term members.

- Bundling Discount: Members who bundle their auto insurance with home or renters insurance can receive additional savings.

- New Vehicle Discount: Available for those who insure a vehicle that is less than three years old.

4. Strong Financial Stability and Efficient Claims Handling

USAA’s financial strength ensures that claims are handled quickly and fairly. With strong ratings from financial institutions such as A.M. Best and Moody’s, USAA has a proven track record of reliability and trustworthiness. Their claims process is streamlined, allowing members to report accidents, track claims, and receive payments efficiently through their online platform or mobile app.

For military members and their families, USAA is the best choice for car insurance due to its exclusive benefits, high customer satisfaction, competitive pricing, and strong financial stability. While membership is limited to those with military affiliations, those who qualify will find that USAA offers some of the best coverage and service available. With a deep understanding of the unique needs of military personnel, USAA continues to be a trusted provider for those who serve and protect the nation.

Choosing the Right Insurance Provider in New York

Selecting the best insurance provider depends on your individual needs and priorities. Here are a few tips to help you make the right decision:

- Consider Coverage Needs: Make sure the company offers the types of coverage you require.

- Compare Quotes: Get multiple quotes to find the best rates.

- Check Customer Reviews: Look for feedback on claims processing and customer service.

- Evaluate Discounts: Many insurers offer discounts that can significantly reduce your premium.

- Assess Financial Stability: A financially stable company will be able to pay out claims reliably.

Final Thoughts

New York has a competitive insurance market, and finding the best provider requires research and careful consideration. Whether you’re looking for affordability, digital convenience, excellent customer service, or specialized coverage, the companies listed above stand out as top choices.

By understanding your insurance needs and comparing your options, you can secure the best policy that offers both value and peace of mind. Take your time, explore your choices, and choose an insurer that best aligns with your requirements.